We are Marcena

Some celebrate uniformity or perfection but we find this to be dull.

We prize imperfect differences in backgrounds and strengths, with experience and ambition.

It is this entropy that allows us to be open to good ideas which in turn can come from anywhere with no relation to age, level, or rank.

Strategy

Marcena Capital Ltd has three business models: 1) asset allocation, financing, fiduciary, portfolio, and exit advice to its core Client Group. The Client Group consists of Ultra HNWs and Single Family Offices, such as Quantum Pacific, BlackPine, and Oosterbaan Investment Group; 2) We are Partnership driven and we pool investors into these Partnerships; deploying more than $250 million directly into these Partnerships since 2014 and doing on average two funds each year; and 3) We actively advise on our Client Group's Healthcare Businesses driving sustainable operational efficiency and strategic growth.

Selection of recent Investment Partners:

Leadership

Lucy Morrisey – Managing Director

Lucy Morrisey has experience spanning two decades in healthcare policy, strategy, and leadership. Lucy was previously Director at Johnson & Johnson, Operations Director in the UK National Health Service, and began as a Senior Associate in Corporate Finance at PwC. Lucy graduated from the London School of Economics and Birmingham and Manchester Business Schools. As Managing Director, Lucy runs Day-to-Day Operations, Capital Formation, and Strategy Advisory.

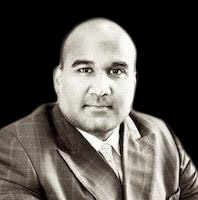

Dhruv Sharma – CEO

Dhruv Sharma has experience across two decades within Private Equity, Venture Capital, and Real Assets Investing. Prior to establishing Marcena Capital Ltd in 2014, Dhruv was Asset Allocation Director at Strategic Assets Partners LLP (‘SAP’). Dhruv graduated with Distinction from the London School of Economics and University of Warwick. As CEO, Dhruv presides over Due Diligence, Fiduciary, and Board Advisory.

Investment Advisory Board

Sach Chandaria

Sach Chandaria is a member of a multi-generational family; besides Philanthropy, Sach has an active role in the family’s businesses in the areas of software, technology, and media. He holds an MBA from Harvard Business School and a BA from Brown University.

Osamu Hosokubo

Osamu Hosokubo was CEO of Japan Asia Investment Co., Ltd., founded in 1981 and a strategic pioneer in Japanese investment into Private Equity and Venture Capital. Osamu joined JAIC in 1989 and prior to this Osamu was with Nippon Trust Bank.

Michael Hecht

Michael Hecht is Director of Hecht Management, investing into core Real Estate and providing Advisory on Acquisition and Development. Previously, Michael invested for the Thyssen Family; and more latterly invested into Healthcare and Venture.

Jean-Philippe de Schrevel

Jean-Philippe de Schrevel invested more than $1.5bn globally into Private Equity and Private Debt as the Co-Founder of Blue Orchard in 2001 and Founder of Bamboo Capital in 2007. Having started at McKinsey, Jean-Philippe holds an MBA from Wharton.

Chief Investment Officer

Shashank Sripada

Shashank Sripada has a decade of experience in Investment Management and previously was Investment Director at Marcena Capital Ltd. Prior to Marcena Capital Ltd, he was Senior Analyst at ‘SAP’. Additionally, Shashank founded ‘Bubblo’. Shashank graduated from the London School of Economics and George Washington University.

Investment Director

Wilfred van Opstal

Wilfred van Opstal heads Asia for Marcena Capital Ltd with an allocation focus on Real Estate, Energy, and Private Equity Tech; Wilfred has been previously with ‘SAP’, ING, and Winterthur.

Mark Walenbergh

Mark Walenbergh, CFA, has previous experience as Executive Director at Santander, Jefferies, and PIMCO. Mark has an institutional and asset management focus on Benelux.

Inna Bratakusuma

Inna I. Bratakusuma has three decades of experience and worked at Maybank Asset Management, ImQ Consulting, and Bank Bukopin in Indonesia. Inna graduated in Civil Law from Universitas Islam Nusantara.

Neil O’Neill

Neil O’Neill has prior experience at Accenture and Marcena Capital Ltd. Neil graduated with first class honours from the London School of Economics and is an MBA Candidate at London Business School.

Vice-President, Investment

Edin Buzuku

Edin Buzuku founded Group Buzuku, active in Property and Olive Trade. He was V-P at ‘SAP’ and graduated from University of Belgrade.

Shruti Kanoria

Shruti Kanoria has spent a decade working under Marcena Capital Ltd and previously as Analyst at ‘SAP’. Shruti graduated from the University of Mumbai.

Analyst Fellowship

The Analyst Fellowship provides the next generation with the asset management skills set we have been fortunate to learn and acquire as well as the chance equal to the one we had in the first twenty years of the 21st Century. Past and Current Fellows include:

Daniel Stuccilli (University of Southern California)

Shivam Brahmbhatt (University of Southern California)

Stuart Tweedie (University of Baltimore)

Neil O'Neill (London School of Economics)

Shruti Kanoria (University of Mumbai)